Contractor or an employee

The ATO appear to be hot again on this issue with another round of targeting the building and construction industry for contractors who are really employees, thus avoiding PAYG withholding taxes and superannuation.

Remember if you are a business check you are not really an employee of anyone who pays you. Conversely that anyone you pay is disguised as a contractor but in actual fact an employee.

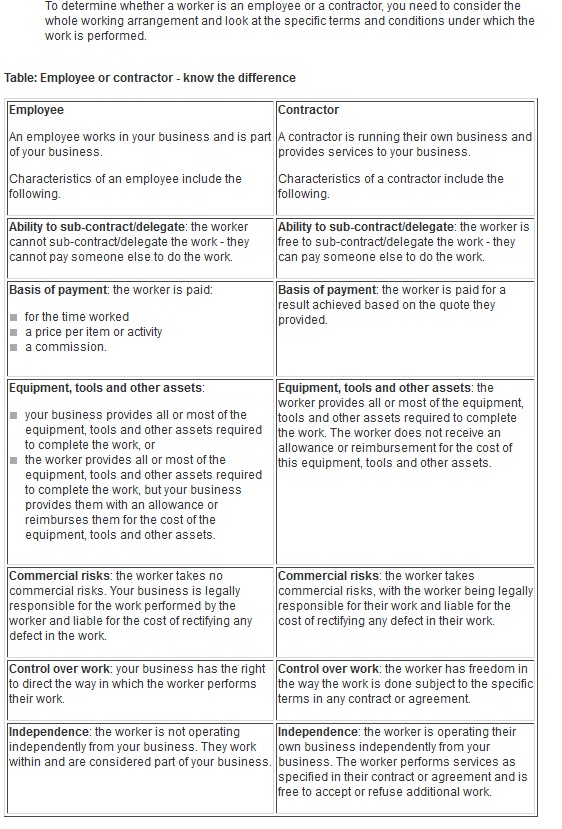

The criteria ATO consider whether you are an employee or contractor are:

Break free with Tax Accounting Adelaide Services call us on 83374460

- Sole trader, Partnership, Company and Trust Tax and BAS returns;

- Self Managed Super Funds;

- Bookkeeping and Choosing Accounting Software;

- New business Start ups Advise;

- Specialising in personal training businesses;

- Improving your business through our business blood test check up;

- We help you get leads with our own business networking events.

More than just Bookkeeping, Bas returns and Tax returns – At Tax Accounting Adelaide we use accounting to grow your business